credit

How to Get a Motorcycle Loan With Bad Credit

adidasw1

The open road awaits, and you’ve got your eye on a motorcycle that will make the ride all the more ...

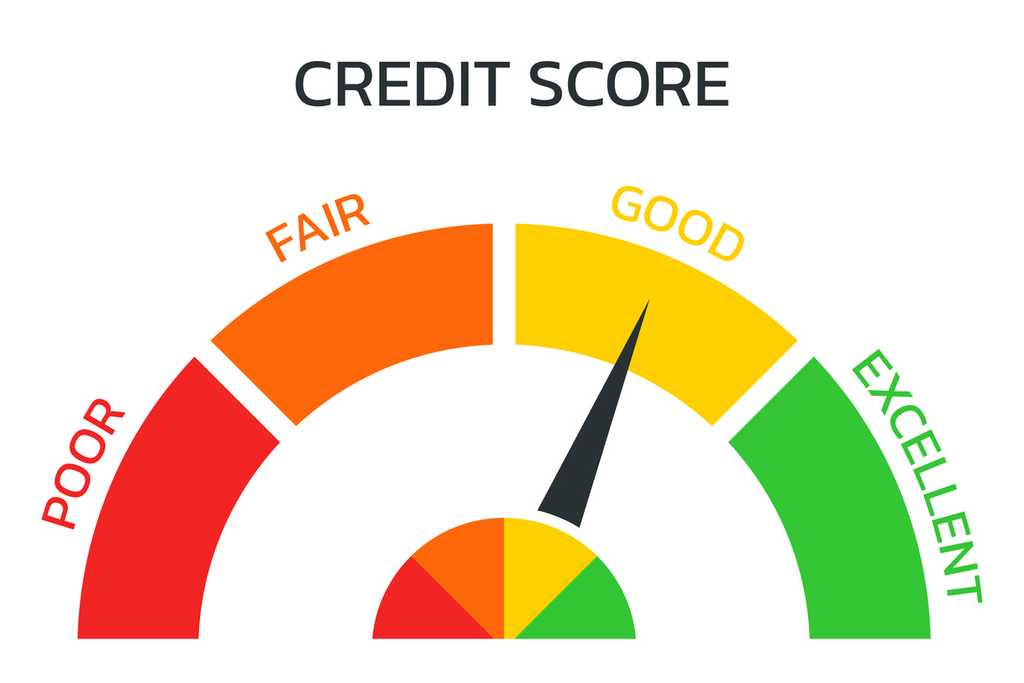

What is a credit score?

adidasw1

A credit score might seem like a simple three-digit number, but it holds considerable power in the financial world. It ...

What is a good credit score?

adidasw1

In the financial world, your credit score can be likened to a report card that reflects your creditworthiness. This three-digit ...