In the financial world, your credit score can be likened to a report card that reflects your creditworthiness. This three-digit number plays a significant role in your financial journey, influencing everything from the interest rates you’re offered to your ability to secure a mortgage or rental property. This article will delve into the intricacies of credit scores, helping you understand what constitutes a good credit score and how you can achieve it.

Understanding Credit Scores

Before we discuss what a good credit score is, it’s crucial to understand what a credit score is and how it’s determined. A credit score is a numerical representation of your credit history, calculated based on the information in your credit report. It’s used by lenders to assess the risk they undertake when they lend you money or provide a line of credit.

Several models can be used to calculate credit scores, but the most widely used one is the FICO Score, developed by the Fair Isaac Corporation. The FICO Score ranges between 300 and 850 and is calculated based on five components:

Payment History (35%): This reflects whether you’ve paid past credit accounts on time.

Amounts Owed (30%): This indicates the total amount of credit and loans you’re utilizing compared to your total credit limit, also known as your credit utilization ratio.

Length of Credit History (15%): This considers how long your credit accounts have been open, including the age of your oldest account, the age of your newest account, and the average age of all your accounts.

Credit Mix (10%): This refers to the variety of credit types you have, such as credit cards, retail accounts, installment loans, mortgage loans, etc.

New Credit (10%): This takes into account how many new accounts you’ve opened or applied for recently, including the number of hard inquiries on your credit report.

What is a Good Credit Score?

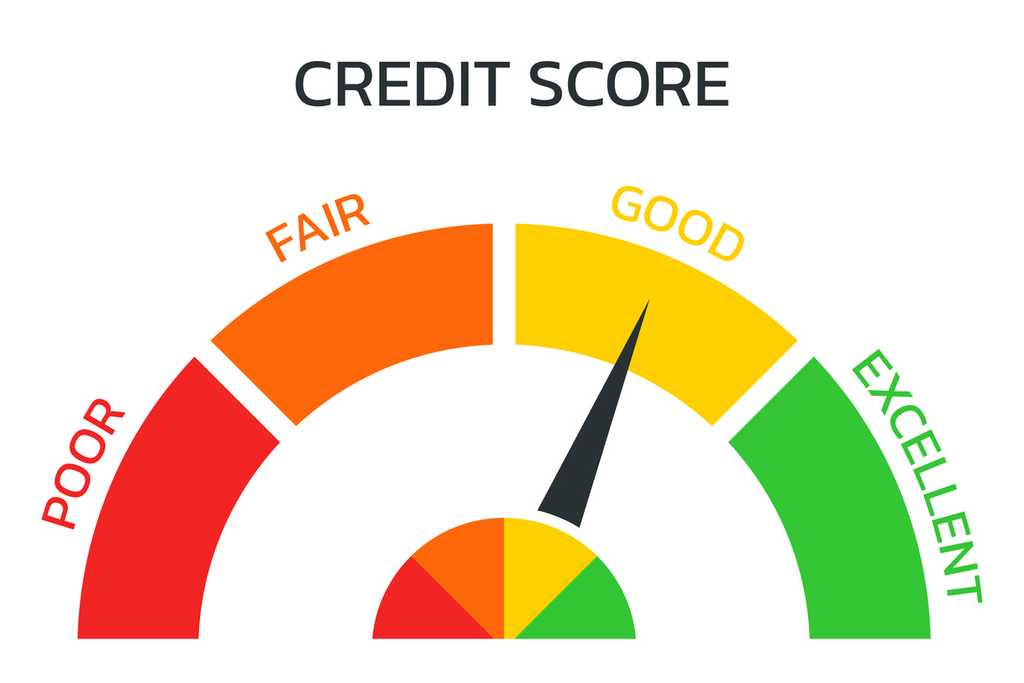

Now that we understand what a credit score is and how it’s calculated let’s discuss what constitutes a good credit score. FICO Scores are often categorized as follows:

800-850: Exceptional

740-799: Very good

670-739: Good

580-669: Fair

300-579: Poor

A score between 670 and 739 is generally considered good. A score between 740 and 799 is considered very good, indicating that you’re a reliable borrower who’s less likely to default on your financial obligations. A score of 800 or above is exceptional, placing you well above the average credit score and making you a highly desirable borrower.

However, it’s important to note that these categories can vary between different lenders. Some might consider a score of 660 as good, while others might set the bar at 680.

Why is a Good Credit Score Important?

A good credit score can open doors to various financial opportunities. It can help you:

Secure Lines of Credit: Lenders are more likely to approve credit card and loan applications from individuals with good credit scores.

Get Lower Interest Rates: A good credit score often qualifies you for lower interest rates on loans and credit cards, which can save you a substantial amount of money over time.

Rent Homes and Apartments: Many landlords check potential tenants’ credit scores. A good credit score can increase your chances of securing the rental property you desire.

Obtain Lower Insurance Premiums: Some insurance companies use credit scores to determine insurance premiums. A good credit score can potentially lower the cost of your insurance.

How to Achieve a Good Credit Score

Achieving a good credit score isn’t an overnight process. It requires consistent financial responsibility, discipline, and time. Here are some strategies to help you improve your credit score:

Pay Your Bills on Time: Since payment history is the most influential factor in your credit score, ensure you pay all your bills on time. This includes not only your credit card bills and loans but also rent, utilities, and even cell phone bills. Setting up automatic payments can help ensure you don’t miss any payments.

Keep Your Credit Utilization Low: Try to keep your credit utilization ratio – the amount of credit you’re using compared to your total credit limit – below 30%. This shows lenders that you’re not overly reliant on credit.

Don’t Close Old Credit Cards: The length of your credit history contributes to your credit score. Keeping old credit cards open, even if you don’t use them, can help maintain a longer average credit history.

Limit Hard Inquiries: Each time you apply for a new line of credit, a hard inquiry is reported on your credit file, which can lower your credit score. Only apply for new credit when you genuinely need it.

Maintain a Mix of Credit Types: Having a variety of credit types – credit cards, student loans, auto loans, mortgages, etc. – can demonstrate to lenders that you can manage different types of credit responsibly.

Monitor Your Credit Reports: Regularly reviewing your credit reports can help you identify any errors or fraudulent activities that might be negatively impacting your credit score. You can get a free credit report from each of the three major credit bureaus once a year through AnnualCreditReport.com.

Address Outstanding Debts: If you have any overdue debts, make a plan to pay them off. Debt can significantly impact your credit score, and clearing it can be a big step towards improving your score.

Remember, improving your credit score is a marathon, not a sprint. It takes time to build or repair your credit history. Be patient, and stay committed to your financial health.

A good credit score is key to a healthy financial future. It can provide you with more financial options, better loan terms, and more favorable interest rates. Understanding how your credit score is calculated and what constitutes a good score can help you make informed decisions to build and maintain strong credit. Keep in mind that while achieving a good credit score is important, it should be part of a broader commitment to overall financial health, including saving, investing, and managing money wisely.