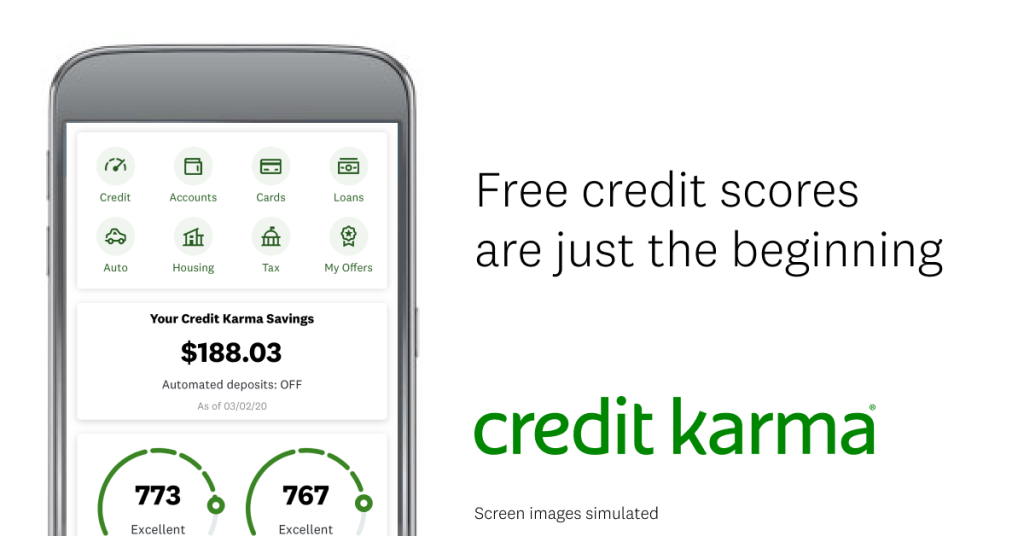

Credit Karma is a personal finance company founded in 2007. It offers free credit score updates, reports, and insights, primarily based on data from TransUnion and Equifax, two of the three major credit reporting agencies. Over the years, many people have wondered, “Are Credit Karma scores legit?” This question arises because sometimes the credit score they see on Credit Karma might be different from the score given by lenders when they apply for credit. In this essay, we will explore the legitimacy of Credit Karma scores and understand why discrepancies may occur.

First, it is essential to understand what a credit score is. It is a numerical representation of an individual’s creditworthiness, determined by evaluating their credit history. Lenders use it to assess the risk associated with lending money or providing credit. The higher the score, the lower the perceived risk.

The most commonly used credit scoring models are FICO (Fair Isaac Corporation) and VantageScore. FICO scores range from 300-850 and are used by about 90% of top lenders. VantageScore, on the other hand, is a model developed by the three major credit bureaus: Equifax, Experian, and TransUnion. It also uses a 300-850 scoring range. Both models assess factors such as payment history, credit utilization, length of credit history, types of credit, and recent inquiries. However, they weigh these factors slightly differently, which can result in different scores.

Credit Karma provides VantageScore 3.0 credit scores from TransUnion and Equifax. Hence, the scores you see on Credit Karma are legitimate, in that they are true VantageScores based on information from two of the three major credit bureaus. However, they may not be the exact scores that a lender sees when they pull your credit report.

Why might there be a difference? There are a few reasons. First, as mentioned earlier, not all lenders use VantageScore; many use FICO scores. So if a lender pulls your FICO score, it could be different from your VantageScore on Credit Karma. Second, lenders might use different versions of these scoring models. For example, there are several versions of FICO scores, such as FICO Score 8 and FICO Score 9, and industry-specific scores like FICO Auto Score 8. Credit Karma uses VantageScore 3.0, but other versions like VantageScore 4.0 also exist.

Third, the timing of when scores are updated can affect what you see. Credit Karma updates your scores once a week, but your lenders might report to the credit bureaus at different times of the month. This means your credit report (and therefore your credit score) can change frequently. So if you checked Credit Karma a week ago, the score you see today might be different because new information has been reported to the credit bureaus.

Finally, not all lenders report to all three credit bureaus. If a lender only reports to Experian and not to TransUnion or Equifax, that information won’t be reflected in the scores you see on Credit Karma.

In conclusion, Credit Karma scores are legitimate in that they are actual credit scores based on real credit report data. However, they may not be the same scores used by a lender when you apply for credit. Therefore, while Credit Karma is a valuable tool for tracking your credit health and understanding what factors affect your score, you should not expect your Credit Karma scores to be exactly the same as those used by all lenders.

It’s always recommended to use services like Credit Karma as a starting point to understand your financial behavior. Still, it’s not a definitive representation of the creditworthiness interpreted by all lenders. To ensure you have the most accurate idea of your credit standing, you may want to review your credit reports from all three credit bureaus and consider your FICO scores. You are entitled to a free report from each bureau every 12 months via AnnualCreditReport.com, and many credit card issuers offer free FICO score updates.

Maintaining good financial habits like making payments on time, keeping your credit utilization low, and applying for credit sparingly are the most reliable ways to improve your credit score, regardless of the model used. These habits reflect positively on both VantageScore and FICO models.

Furthermore, if you’re planning to make a significant financial decision, like applying for a mortgage or auto loan, consider directly asking your lender which scoring model they use. This way, you can check that specific score to ensure you have the most accurate understanding of your creditworthiness.

In sum, Credit Karma provides a valuable free service that allows consumers to monitor their credit and understand the factors influencing their credit scores. Even though the scores provided may differ from the ones used by lenders, the discrepancy does not invalidate the utility of Credit Karma’s service. It is a useful tool in the broader context of credit management and financial literacy. Thus, while Credit Karma scores might not be the “final word” from a lender’s perspective, they are indeed legitimate and offer a valuable resource for personal finance management.