Binance, known as one of the leading cryptocurrency exchanges globally, is currently facing several challenges:

Legal Challenges and Revenue Impact: Binance’s U.S. operations have seen a significant drop in revenue, reportedly by 70% in 2023, amid ongoing legal battles. This decline could have a notable impact on the company’s operations and its future growth trajectory.

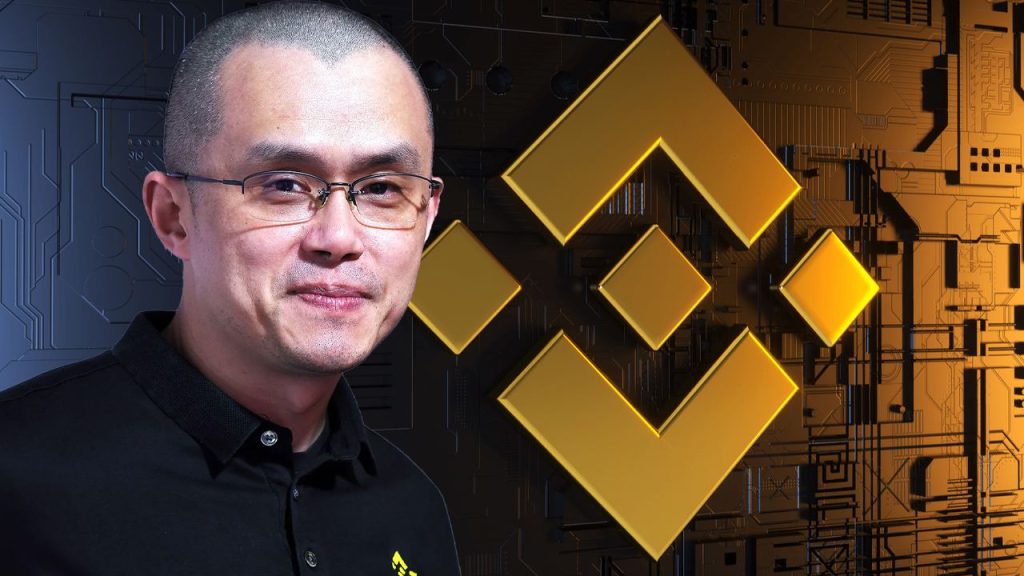

Guilty Plea to Federal Charges: Changpeng Zhao, the CEO and founder of Binance, known as “CZ,” has pleaded guilty to federal charges. As a part of these legal troubles, Binance has agreed to pay fines amounting to $4.3 billion.

Regulatory Scrutiny: The Securities and Exchange Commission (SEC) has made a claim against Binance’s stablecoin, BUSD, asserting that it should be classified as a security. This adds another layer of regulatory complexity for the company.

Industry Implications: The crypto industry is closely watching Binance’s handling of these issues. There is a belief that how Binance resolves these challenges could set a precedent for other crypto entities that might face similar regulatory examinations. The outcome could significantly influence the regulatory landscape for the crypto industry in the coming years.

The implications for the crypto industry are broad. These challenges faced by Binance highlight the increasing regulatory scrutiny that crypto exchanges are under. The outcomes of Binance’s legal and regulatory hurdles may influence future regulatory approaches towards the crypto industry, potentially affecting how cryptocurrencies are classified and regulated worldwide. It also underscores the industry’s need for compliance with existing financial regulations, particularly anti-money laundering laws, which could lead to more rigorous compliance demands for crypto companies. The situation also reflects the volatility and risks associated with the crypto market, which could lead to more cautious investment and innovation in the space until there is clearer regulatory guidance.

The situation with Binance is quite critical for the crypto industry for several reasons:

Precedent for Regulation: How regulators deal with Binance could set a legal and regulatory precedent for other exchanges and crypto businesses. If Binance navigates through its current challenges successfully, it may pave the way for how other companies can align with regulatory expectations. Conversely, if Binance faces severe penalties, it could signal a tightening of the regulatory environment for all players in the crypto space.

Market Confidence: Binance’s ability to handle these issues may also affect market confidence in cryptocurrencies. Legal troubles and accusations of inadequate anti-money laundering measures could lead to a loss of trust among investors and users, which might result in a pullback from crypto investments and a demand for higher standards of compliance and transparency.

Innovation vs. Regulation Balance: The crypto industry has been a space of rapid innovation, often outpacing regulation. Binance’s challenges underscore the tension between the need to innovate and the need to comply with existing financial laws. This balance will be essential as the industry matures and seeks to gain broader acceptance among traditional investors and the general public.

Global Impact: Given that Binance operates on a global scale, the outcomes of its legal challenges may have international implications. Different countries may take cues from how the United States handles the situation, potentially leading to a more harmonized global regulatory framework for cryptocurrencies.

Stablecoin Scrutiny: The SEC’s stance on Binance’s stablecoin, BUSD, being classified as a security could have far-reaching effects on the stablecoin market, which is a vital part of the crypto ecosystem. If stablecoins are to be regulated as securities, it could lead to significant changes in how they are issued, managed, and traded.

Overall, the crypto industry is at a pivotal point, and the unfolding events surrounding Binance could either reinforce the current trajectory of growth with increased regulatory compliance or lead to a more constrained environment that could stifle innovation and expansion. The next few months to a year will be critical in determining the direction the industry takes.

As the Binance situation unfolds, it holds significant implications for various aspects of the cryptocurrency world:

Enforcement and Legal Actions: The magnitude of enforcement actions against Binance could influence the severity of future legal actions against other crypto entities. If regulators and law enforcement agencies perceive that hefty fines and strict enforcement actions are effective, it could lead to a more aggressive stance in future cases.

Compliance Culture: Binance’s response to these challenges is crucial in establishing a culture of compliance within the crypto industry. If Binance implements robust compliance measures, it could encourage other companies to proactively enhance their compliance frameworks, potentially leading to a more stable and reputable market.

Investor Protection: The regulatory outcome will likely have a direct impact on investor protection measures within the crypto industry. This includes the handling of customer assets, transparency in transactions, and overall market integrity, which are paramount for investor confidence.

Cross-Border Cooperation: Given Binance’s global presence, its challenges may foster increased international regulatory cooperation. Global financial crimes require a coordinated response, and the Binance case could catalyze more collaborative cross-border regulatory efforts.

Institutional Participation: The institutional investment community closely monitors regulatory developments. Clearer regulations, as a result of Binance’s current legal challenges, could either encourage or discourage institutional participation based on perceived regulatory stability and market risks.

Cryptocurrency’s Legal Status: The legal definitions applied to cryptocurrencies and related activities, such as whether certain tokens are considered securities, will have long-term implications for the industry. The SEC’s scrutiny of Binance’s stablecoin could influence the classification of other cryptocurrencies, affecting how they can be legally traded and held by businesses and consumers.

Innovation Trends: Finally, the balance between regulation and innovation will affect the kinds of products and services that emerge in the crypto space. A harsh regulatory response could deter innovation, while a measured approach might allow for continued technological development alongside increasing user protection.

The broader crypto industry, therefore, is at a juncture where the actions taken by one of its largest players in response to regulatory pressures will have a ripple effect, influencing not just market dynamics but also the strategic direction of other crypto businesses and the evolution of regulatory policies globally.