The ongoing student loan debt crisis has been a central focus of policy discussions in recent years, especially as the financial burden on American students continues to grow. Amidst the economic turmoil caused by the COVID-19 pandemic, the Biden administration took several steps to address the issue, one of which involved the proposal of a student loan forgiveness program that promised to relieve millions of borrowers of up to $20,000 in federal student debt1. However, the Supreme Court struck down this program, throwing a wrench in the Biden administration’s plans.

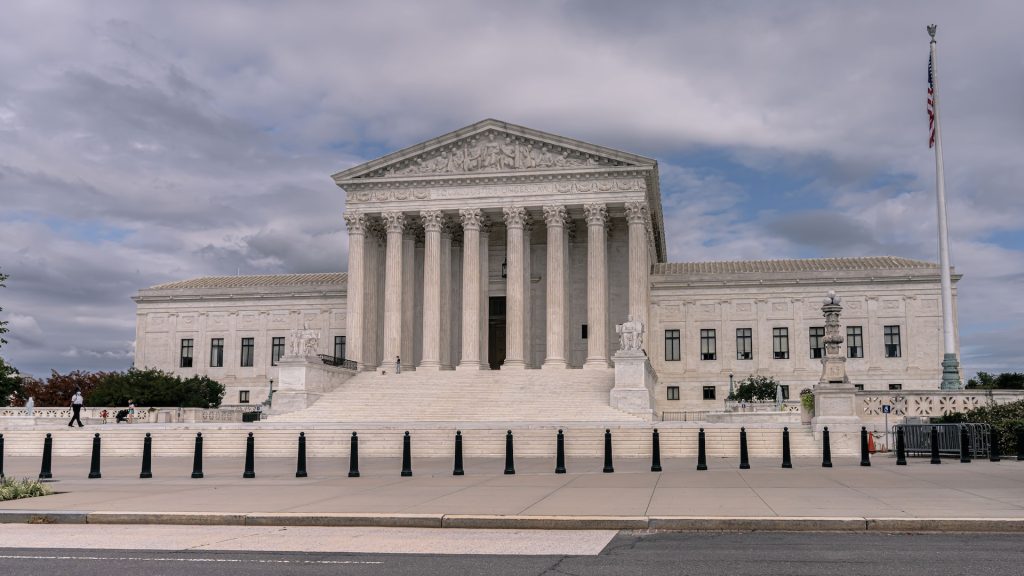

The student loan forgiveness program, announced by President Biden in August 2022, never took effect due to legal challenges and was ultimately halted by the Supreme Court just a few months before student loan payments were slated to restart following a years-long pause. Despite this setback, the Biden administration remains committed to providing some form of student debt relief and has set its sights on alternative pathways to achieve this goal.

In response to the Supreme Court ruling, the administration announced a new strategy grounded in the Higher Education Act (HEA) of 1965, a law that governs most federal student loan programs. This new approach aims to provide as much relief as possible to student loan borrowers, making use of a different legal basis than the original plan. The specifics of this new pathway remain somewhat uncertain, but it requires the Department of Education to undertake a formal rule-making process, which is expected to take several months.

The HEA, which established the foundations of the modern American college funding system, gave the Secretary of Education broad authority to collect debts, and advocates have argued that this power implicitly grants the Department of Education the authority to forgive those debts. In particular, the administration’s current plan leverages a provision in the post-9/11 HEROES Act that enables the Secretary of Education to waive or modify provisions applicable to the student financial assistance programs governed by the HEA.

In addition to the HEA-based strategy, the Biden administration has announced a temporary 12-month “on-ramp” plan to ease the transition for borrowers when monthly loan repayments resume in October 202323. This plan aims to mitigate the financial impact on borrowers, ensuring that missed payments during this period will not harm their credit scores or lead to loan defaults.

Furthermore, the administration has implemented changes to several existing debt cancellation programs, expanding eligibility and reducing monthly payments for eligible borrowers1. The Public Service Loan Forgiveness program, aimed at helping government and nonprofit workers, has seen a broadening of its eligibility criteria, while a new income-driven repayment plan proposal seeks to reduce the amount borrowers pay back over time. The Department of Education has also made it easier for borrowers who were misled by their for-profit college to apply for student loan forgiveness under a program known as the borrower defense to repayment.

Despite these efforts, it is important to note that the administration’s initiatives have not yet resulted in the widespread cancellation of student debt, even though about 16 million applications for relief were approved last year. The projected cost of the now-defunct forgiveness program was estimated at $400 billion and would have fulfilled a campaign promise of Biden’s to cancel some student debt.

While the Supreme Court’s decision has complicated the Biden administration’s plans, it has not deterred them from seeking alternative pathways to provide student debt relief. These efforts include not only attempts to harness the powers granted by the Higher Education Act but also the implementation of new debt relief programs and modifications to existing ones. The success of these endeavors will undoubtedly play a significant role in shaping the financial futures of millions of American students and former students.