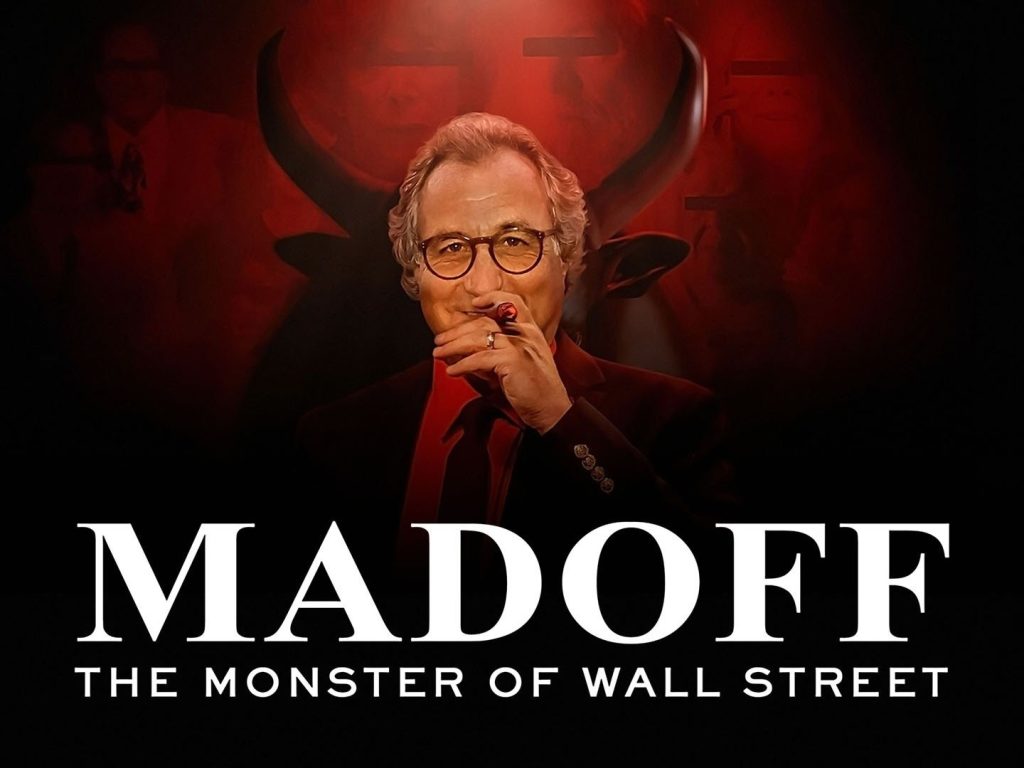

Bernard L. Madoff, often referred to as the “Monster of Wall Street,” was a name that sent shockwaves through the financial world. He orchestrated one of the most extensive and devastating Ponzi schemes in history, defrauding thousands of investors out of billions of dollars. This article delves into the life and crimes of Bernie Madoff, exploring how he managed to deceive the financial community for decades before his house of cards finally collapsed.

Early Life and Career

Born on April 29, 1938, in Queens, New York, Bernie Madoff came from humble beginnings. His parents were both children of European immigrants, and they worked as lifeguards and registered nurses. Madoff’s upbringing was solidly middle-class, and he attended public schools in Laurelton, Queens, before enrolling in the University of Alabama.

Madoff’s career in finance began early when he founded a stock trading and investment advisory firm, Bernard L. Madoff Investment Securities LLC, in 1960. He was determined to make a name for himself on Wall Street, and he started small, focusing on stock trading and market making. Over the years, his firm expanded, and he began to attract a growing number of clients, including high-net-worth individuals, charitable organizations, and even celebrities.

The Rise of the Ponzi Scheme

For decades, Madoff’s investment business seemed remarkably successful. He consistently reported steady, positive returns, even in times of economic downturns. This consistent track record earned him the trust of his clients and allowed his investment firm to grow exponentially. Many investors believed that Madoff possessed a unique ability to generate consistent profits, and they were willing to invest billions of dollars with him.

However, the truth behind Madoff’s success was far from what it seemed. In reality, he was operating the largest Ponzi scheme in history. A Ponzi scheme is a fraudulent investment scheme where returns to earlier investors are paid using the capital of newer investors, rather than actual profits generated by the business. Madoff promised consistent returns to his clients, and he delivered on those promises by using the investments from new clients to pay the returns owed to earlier ones.

The Illusion of Success

One of the most striking aspects of Bernie Madoff’s scheme was the lengths to which he went to maintain the illusion of success. He used sophisticated techniques to falsify financial statements, creating an image of a thriving investment business. Madoff’s clients received regular statements showing their investments growing steadily, and he was known for being secretive about his investment strategies, which only added to his mystique.

Madoff also cultivated an air of exclusivity around his firm. He often accepted clients on an invitation-only basis, creating an aura of privilege and prestige. Many investors considered it a privilege to invest with Madoff, and this exclusivity added to the allure of his scheme.

The Fallout

The Madoff scheme began to unravel in December 2008, when he confessed to his sons that his investment business was a massive fraud. Faced with mounting financial pressure and unable to meet the increasing withdrawal requests from clients, Madoff knew that his house of cards was about to collapse. He estimated that he owed his clients approximately $65 billion, a staggering sum.

Madoff’s confession to his sons led to his arrest on December 11, 2008. He was charged with securities fraud, investment advisor fraud, and other crimes related to his Ponzi scheme. His arrest sent shockwaves through the financial world and shattered the trust of countless investors who had believed in his integrity for decades.

The Aftermath

Bernie Madoff’s arrest and subsequent conviction sent him to prison for a 150-year sentence, effectively a life sentence for the then-71-year-old financier. His wife, Ruth Madoff, also faced scrutiny and lost much of her personal wealth, although she was not charged with any crimes related to her husband’s scheme.

The fallout from Madoff’s Ponzi scheme was extensive and devastating. Thousands of investors, including individuals, charities, and financial institutions, suffered enormous losses. Many were left financially ruined, and some even lost their life savings. The scandal also raised questions about the effectiveness of regulatory oversight in the financial industry and the need for greater transparency and accountability.

Lessons Learned

The Madoff scandal serves as a cautionary tale for investors and regulators alike. It exposed the dangers of blindly trusting investment professionals and the importance of conducting thorough due diligence before entrusting one’s money to anyone. It also highlighted the need for stronger regulatory oversight and stricter enforcement of financial regulations to prevent such schemes from happening in the future.

In the aftermath of the Madoff scandal, there were calls for reforms in the financial industry, including increased transparency, stricter reporting requirements, and better protection for investors. Regulators and lawmakers sought to learn from the mistakes that allowed Madoff to operate his scheme for so long without detection.

Bernie Madoff’s rise and fall as the “Monster of Wall Street” is a cautionary tale that will be remembered in financial history for generations to come. His ability to deceive investors and maintain the illusion of success for decades serves as a stark reminder of the dangers of blind trust in the financial industry.

The Madoff scandal exposed the weaknesses in regulatory oversight and the need for greater transparency and accountability in the world of finance. It also highlighted the devastating consequences of financial fraud on individuals and organizations alike. While Madoff’s arrest and imprisonment brought some measure of justice, the scars of his Ponzi scheme continue to affect the lives of those who were duped by his promises of wealth and prosperity. The lessons learned from this dark chapter in financial history should serve as a constant reminder of the importance of vigilance and due diligence in the world of investing.

The Legacy of Bernie Madoff

The legacy of Bernie Madoff is a complex and multifaceted one. While he will forever be remembered as the mastermind behind one of the largest financial frauds in history, his story also raises important questions about the broader financial industry and the lessons that can be drawn from his crimes.

Regulatory Reforms: In the wake of the Madoff scandal, there was a significant push for regulatory reforms within the financial industry. Regulators and lawmakers recognized the need for stronger oversight and more stringent regulations to prevent similar Ponzi schemes from happening in the future. The Securities and Exchange Commission (SEC) faced intense scrutiny for its failure to detect Madoff’s fraud earlier, leading to calls for increased funding and resources for regulatory agencies.

Investor Awareness: Madoff’s case underscored the importance of investor education and awareness. It highlighted the need for investors to conduct thorough due diligence and to be cautious of investment opportunities that seem too good to be true. The old adage “if it’s too good to be true, it probably is” gained renewed relevance in the aftermath of Madoff’s downfall.

Lost Trust: The Madoff scandal eroded trust in the financial industry. Many investors who had placed their faith in Madoff’s reputation and track record were left feeling betrayed and disillusioned. Restoring that trust has been a long and arduous process, with financial professionals and institutions working tirelessly to demonstrate their commitment to ethical practices and transparency.

Legal Precedent: The legal consequences faced by Bernie Madoff were significant. His 150-year prison sentence sent a clear message that financial fraud on such a massive scale would not be tolerated. His case served as a precedent for future prosecutions of financial criminals, emphasizing the severity of the punishment that could be meted out to those who engage in fraudulent activities.

Impact on Victims: The victims of Madoff’s Ponzi scheme endured immense financial and emotional hardship. Many faced financial ruin and struggled to rebuild their lives. Some charitable organizations were forced to curtail their activities due to the losses they suffered. The emotional toll on victims cannot be overstated, as they grappled with feelings of betrayal, anger, and loss.

Lessons for Investors: One of the enduring legacies of Bernie Madoff is the lessons that investors can learn from his story. It serves as a reminder to always exercise caution and skepticism when evaluating investment opportunities. Investors should diversify their portfolios, conduct thorough due diligence, and seek independent verification of investment performance. It’s a stark reminder that even seemingly reputable individuals and firms can engage in fraudulent activities.

Calls for Transparency: Madoff’s case prompted calls for greater transparency in the financial industry. Investors and regulators alike emphasized the importance of clear and accurate reporting of investment performance. Transparency helps investors make informed decisions and holds financial professionals accountable for their actions.

Bernie Madoff’s reign as the “Monster of Wall Street” serves as a somber chapter in the history of finance. His audacious Ponzi scheme, which went undetected for decades, had devastating consequences for thousands of investors and tarnished the reputation of the financial industry as a whole. While his downfall resulted in significant regulatory reforms and increased awareness among investors, the scars of his fraud are still felt by those who suffered losses.

The Madoff scandal should be remembered as a stark reminder of the need for vigilance, transparency, and accountability in the financial world. It is a cautionary tale that underscores the importance of learning from past mistakes and taking steps to prevent similar frauds from occurring in the future. The legacy of Bernie Madoff serves as a reminder that even in the world of finance, where trust and reputation are paramount, one must always be vigilant and skeptical to protect one’s financial well-being.