Artificial Intelligence (AI) has surged onto the global scene as a revolutionary technology, altering the way we live and work. The rapid advancement of AI promises to reshape industries and create substantial economic value, thereby presenting investors with exciting and potentially lucrative opportunities. However, understanding how to invest in this high-growth sector requires strategic planning and consideration. This guide will offer a comprehensive overview of how to navigate this unique investment landscape.

Understanding the AI Landscape

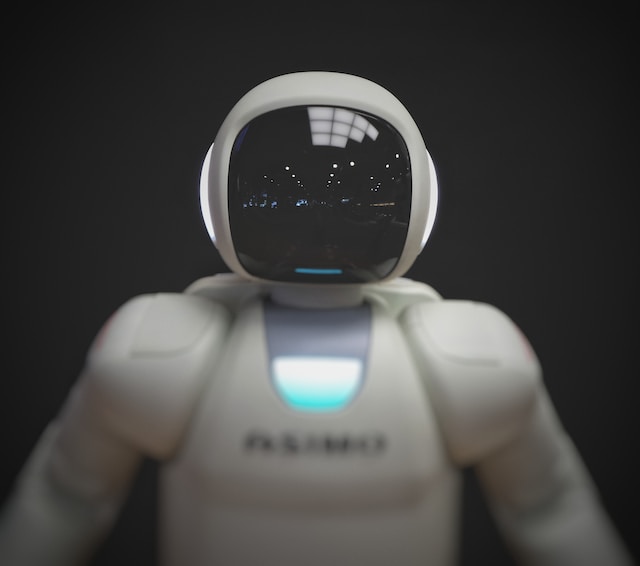

Before investing in AI, it’s important to understand what this technology is, how it works, and its growth potential. AI is a computer science discipline that focuses on creating intelligent machines that work and react like humans. It includes several technologies such as machine learning, natural language processing, robotics, and computer vision. According to estimates from market research firms, the global AI market size is expected to grow exponentially, reaching hundreds of billions of dollars by 2025.

Identifying Investment Opportunities

There are several ways to invest in AI: directly in AI-based companies, through exchange-traded funds (ETFs), and through equity in private start-ups.

Directly in AI Companies: Tech giants like Alphabet, Amazon, Microsoft, and Nvidia are leading the AI revolution. Alphabet’s subsidiary, Google, has DeepMind, one of the most prominent AI research labs, and AI is deeply integrated into many of Google’s products. Amazon uses AI for its recommendation systems and voice assistant Alexa, while Microsoft and Nvidia both offer AI cloud solutions.

Besides tech giants, there are smaller public companies that concentrate on specific AI technologies. For instance, iRobot specializes in robotics, while Twilio is a leader in AI communication systems. Do your due diligence by researching these companies, understanding their financial health, their position within the AI landscape, and their future growth potential.

ETFs: If you want a diversified exposure to AI without investing directly in individual companies, consider AI-focused ETFs. These funds hold shares of multiple companies that are leading in AI technology. The benefit of ETFs is that they spread out the risk across multiple companies.

Examples of AI-focused ETFs include the Global X Robotics & Artificial Intelligence ETF (BOTZ) and the First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT).

Private Equity: If you have more risk appetite and seek higher returns, consider investing in private AI start-ups through venture capital (VC) funds. These start-ups often pioneer cutting-edge AI applications but come with greater risk as many fail to become profitable.

Strategizing Your Investment Approach

Investing in AI should align with your overall investment strategy, considering factors like your risk tolerance, investment horizon, and financial goals.

Research: Like any investment, thorough research is crucial in AI investing. Stay updated with AI trends, understand the potential of different AI technologies, and keep an eye on the leading and emerging players.

Diversification: The tech sector, including AI, can be volatile and unpredictable. Hence, it’s wise to diversify your portfolio. Don’t put all your eggs in the AI basket but consider it as a part of your broader investment portfolio.

Long-term View: AI is a disruptive technology with the potential for massive long-term growth. While there might be short-term volatility, having a long-term view could yield significant returns as AI continues to permeate every industry.

Understanding the Risks

Like any investment, AI investing comes with its own set of risks. The technology is complex and constantly evolving, and companies working in this space need substantial investment for research and development. Regulatory and ethical considerations also present unique challenges.

Moreover, the tech sector is known for its boom and bust cycles, and the AI sector isn’t immune to this volatility. Therefore, it’s essential to manage risk effectively through diversification and diligent research.

Risk Mitigation Strategies

Portfolio Diversification: A balanced investment portfolio spread across various sectors and asset classes can help mitigate the potential risks associated with AI investments. You may opt for a mix of equities, bonds, ETFs, commodities, and real estate to offset possible downturns in the AI market.

Sector Diversification within AI: AI has multiple sub-sectors like machine learning, robotics, natural language processing, and more. Companies may focus on different AI sub-sectors, providing another layer of diversification. Investing in a mix of these companies can shield your investment portfolio from a downturn in a specific AI sub-sector.

Investing in Stable, Profitable Companies: While AI start-ups might provide higher returns, they also carry more risk. Investing a portion of your funds in established tech companies with strong AI divisions can provide relative stability.

Regular Monitoring and Rebalancing: Keep a pulse on your investments and the larger market trends. Reevaluate and rebalance your portfolio regularly to align with your financial goals and risk tolerance.

Staying Updated with AI Trends

The AI landscape is rapidly evolving. To make the most of your investments, it’s crucial to stay updated with the latest trends, breakthroughs, and challenges in the AI industry. Follow AI news on reputable tech news sites, subscribe to AI newsletters, join AI-focused forums, and consider attending AI conferences or webinars.

Understand how regulatory changes, technological advancements, and ethical considerations might impact AI companies. For example, stringent data privacy regulations could impact companies specializing in data-driven AI technologies, while breakthroughs in quantum computing could significantly advance AI capabilities, benefiting companies at the forefront of these innovations.

Investing in artificial intelligence presents an exciting opportunity to be a part of a transformative technological revolution. However, like any investment, it requires a deep understanding of the landscape, thoughtful strategy, and mindful risk management.

Consider the various avenues for investing, including direct investments in AI companies, AI-focused ETFs, and private equity investments through VC funds. Build a diversified portfolio aligned with your risk tolerance and long-term financial goals, and stay updated with the latest trends in the AI industry.

Remember that while the future of AI looks promising, the journey is likely to be marked by periods of volatility and uncertainty. Patience, diligence, and informed decision-making are keys to successful investing in this high-potential sector. Whether you’re a seasoned investor or a newbie, the AI industry presents unique opportunities for growth and diversification, making it a sector worth considering for your investment portfolio.