Equifax

Why is TransUnion so much higher than Equifax?

In the realm of credit reporting agencies, TransUnion and Equifax are two major players, both wielding significant influence over consumers’ ...

What is a credit score?

A credit score might seem like a simple three-digit number, but it holds considerable power in the financial world. It ...

Can you get a car with bad credit?

A car is more than just a vehicle—it’s often a necessity. Whether you need it for work, family obligations, or ...

Can you buy a house with bad credit?

For many, owning a home is a cornerstone of the American dream. However, the path to homeownership can often feel ...

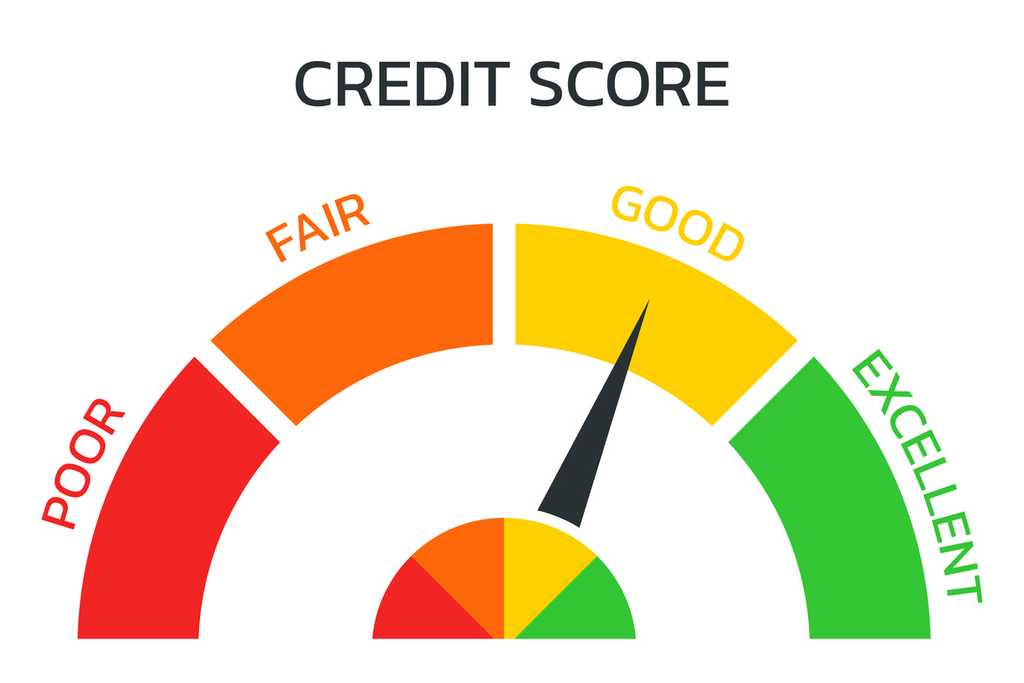

What is a good credit score?

In the financial world, your credit score can be likened to a report card that reflects your creditworthiness. This three-digit ...