credit score

what credit score is needed to buy a mobile home

Purchasing a mobile home presents a unique set of financial considerations, not least of which is the credit score required ...

how to start a credit repair business from home

Starting a credit repair business from home can be a rewarding endeavor, both financially and personally, as you’ll be helping ...

Why is TransUnion so much higher than Equifax?

In the realm of credit reporting agencies, TransUnion and Equifax are two major players, both wielding significant influence over consumers’ ...

Whose Credit Score is used on a Joint Mortgage?

When applying for a joint mortgage, understanding how credit scores are evaluated is crucial, as it can significantly affect the ...

What kind of credit score do you need for a rehab loan?

In the realm of real estate, the pursuit of property rehabilitation often requires financial assistance beyond conventional mortgage options. This ...

How to Make Money (for Kids)

It’s never too early to start learning about money and how to earn it. As a kid, you might think ...

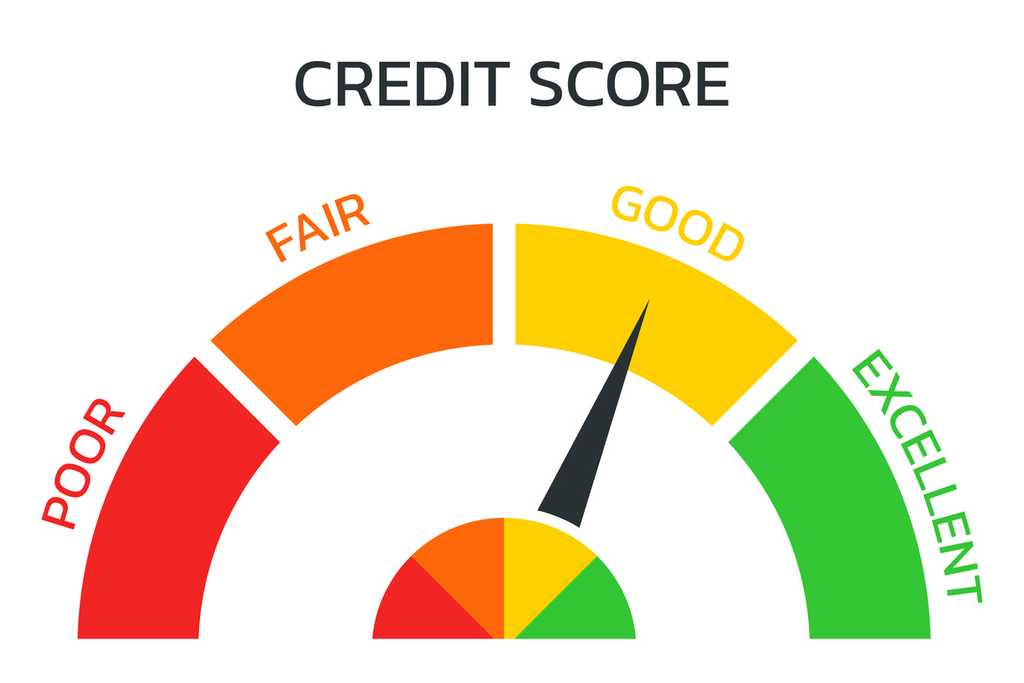

What is a credit score?

A credit score might seem like a simple three-digit number, but it holds considerable power in the financial world. It ...

What is a good credit score?

In the financial world, your credit score can be likened to a report card that reflects your creditworthiness. This three-digit ...